Utah Sales Tax Rate Changes 2022 . 1 announced changes to local sales and use and excise tax rates effective jan. Follow this link to view. Utah has state sales tax of 4.85%, and allows local. 65 rows the following sales tax changes were made effective in the respective quarters listed below. These rates are weighted by population to compute an. 270 rows utah sales tax: 4.85% (general) or 1.75% (food or food ingredients) • county option rate: (a) city, county and municipal rates vary. the utah state tax commission dec. state & local sales tax rates, as of january 1, 2022. 100 rows the most recent sales tax rate changes; the utah state tax commission nov. Average sales tax (with local): sales & use tax:

from www.signnow.com

sales & use tax: 4.85% (general) or 1.75% (food or food ingredients) • county option rate: 100 rows the most recent sales tax rate changes; Utah has state sales tax of 4.85%, and allows local. (a) city, county and municipal rates vary. the utah state tax commission dec. Average sales tax (with local): 1 announced changes to local sales and use and excise tax rates effective jan. 65 rows the following sales tax changes were made effective in the respective quarters listed below. Follow this link to view.

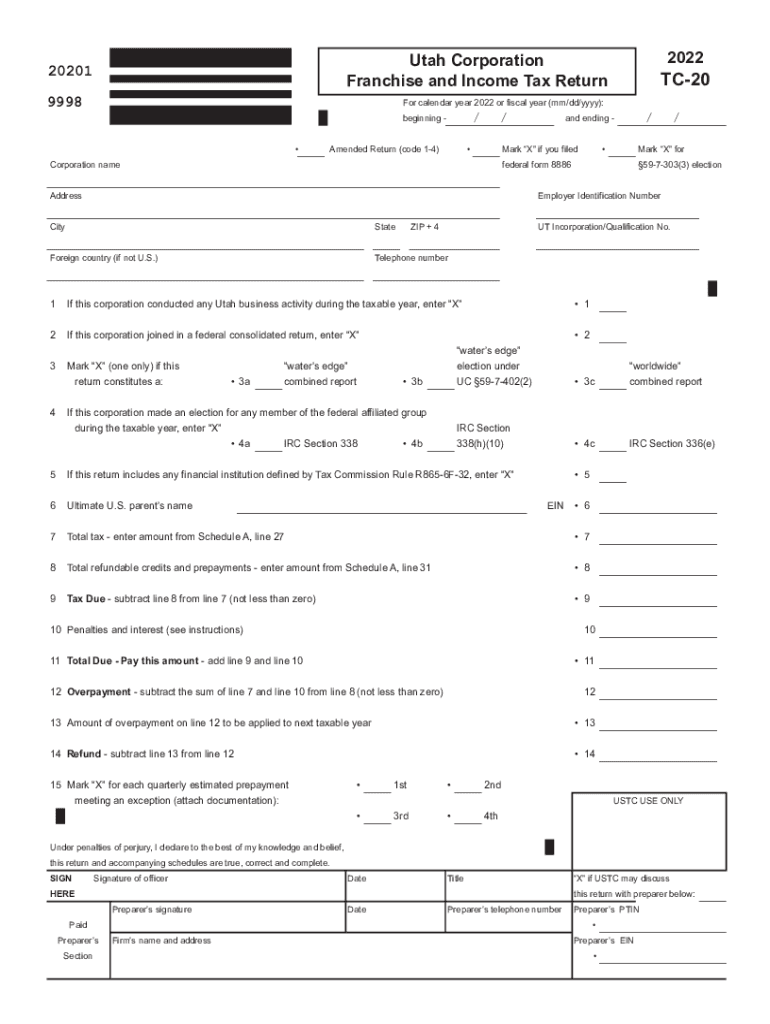

Utah Tax S 20222024 Form Fill Out and Sign Printable PDF Template

Utah Sales Tax Rate Changes 2022 4.85% (general) or 1.75% (food or food ingredients) • county option rate: 100 rows the most recent sales tax rate changes; the utah state tax commission dec. 270 rows utah sales tax: sales & use tax: Average sales tax (with local): 65 rows the following sales tax changes were made effective in the respective quarters listed below. the utah state tax commission nov. Follow this link to view. (a) city, county and municipal rates vary. 1 announced changes to local sales and use and excise tax rates effective jan. These rates are weighted by population to compute an. 4.85% (general) or 1.75% (food or food ingredients) • county option rate: state & local sales tax rates, as of january 1, 2022. Utah has state sales tax of 4.85%, and allows local.

From www.pdffiller.com

Fillable Online tax utah Sales tax rates effective July 1, 2022 Utah Sales Tax Rate Changes 2022 Utah has state sales tax of 4.85%, and allows local. the utah state tax commission nov. 100 rows the most recent sales tax rate changes; 270 rows utah sales tax: state & local sales tax rates, as of january 1, 2022. Follow this link to view. 4.85% (general) or 1.75% (food or food ingredients) • county. Utah Sales Tax Rate Changes 2022.

From marykaybylydia.blogspot.com

davis county utah sales tax rate Jacelyn Doran Utah Sales Tax Rate Changes 2022 sales & use tax: Utah has state sales tax of 4.85%, and allows local. the utah state tax commission nov. state & local sales tax rates, as of january 1, 2022. 4.85% (general) or 1.75% (food or food ingredients) • county option rate: (a) city, county and municipal rates vary. 1 announced changes to local sales and. Utah Sales Tax Rate Changes 2022.

From burtbrothers.com

Sales Tax On Cars In Utah Burt Brothers Utah Sales Tax Rate Changes 2022 Average sales tax (with local): the utah state tax commission dec. Utah has state sales tax of 4.85%, and allows local. 65 rows the following sales tax changes were made effective in the respective quarters listed below. (a) city, county and municipal rates vary. 100 rows the most recent sales tax rate changes; the utah state. Utah Sales Tax Rate Changes 2022.

From printablethereynara.z14.web.core.windows.net

State And Local Sales Tax Rates 2020 Utah Sales Tax Rate Changes 2022 100 rows the most recent sales tax rate changes; These rates are weighted by population to compute an. Average sales tax (with local): the utah state tax commission nov. 65 rows the following sales tax changes were made effective in the respective quarters listed below. Follow this link to view. 4.85% (general) or 1.75% (food or food. Utah Sales Tax Rate Changes 2022.

From stevenawetti.pages.dev

Utah Sales Tax Calculator 2024 Karon Maryann Utah Sales Tax Rate Changes 2022 (a) city, county and municipal rates vary. sales & use tax: 65 rows the following sales tax changes were made effective in the respective quarters listed below. 270 rows utah sales tax: the utah state tax commission dec. Average sales tax (with local): 1 announced changes to local sales and use and excise tax rates effective. Utah Sales Tax Rate Changes 2022.

From texas-custom-trucks-0.blogspot.com

summit county utah sales tax rate Like The Great Log Image Bank Utah Sales Tax Rate Changes 2022 4.85% (general) or 1.75% (food or food ingredients) • county option rate: the utah state tax commission nov. Average sales tax (with local): These rates are weighted by population to compute an. 100 rows the most recent sales tax rate changes; sales & use tax: Utah has state sales tax of 4.85%, and allows local. the. Utah Sales Tax Rate Changes 2022.

From twilarudolph.blogspot.com

davis county utah sales tax rate Twila Rudolph Utah Sales Tax Rate Changes 2022 4.85% (general) or 1.75% (food or food ingredients) • county option rate: 65 rows the following sales tax changes were made effective in the respective quarters listed below. Average sales tax (with local): 1 announced changes to local sales and use and excise tax rates effective jan. These rates are weighted by population to compute an. Follow this link. Utah Sales Tax Rate Changes 2022.

From 1stopvat.com

Utah Sales Tax Sales Tax Utah UT Sales Tax Rate Utah Sales Tax Rate Changes 2022 Average sales tax (with local): 100 rows the most recent sales tax rate changes; These rates are weighted by population to compute an. Utah has state sales tax of 4.85%, and allows local. Follow this link to view. (a) city, county and municipal rates vary. state & local sales tax rates, as of january 1, 2022. the. Utah Sales Tax Rate Changes 2022.

From taxfoundation.org

Utah Sales Tax A Policymakers’ Guide to Modernizing Utah’s Sales Tax Utah Sales Tax Rate Changes 2022 4.85% (general) or 1.75% (food or food ingredients) • county option rate: 100 rows the most recent sales tax rate changes; These rates are weighted by population to compute an. 270 rows utah sales tax: state & local sales tax rates, as of january 1, 2022. 65 rows the following sales tax changes were made effective. Utah Sales Tax Rate Changes 2022.

From texas-custom-trucks-0.blogspot.com

summit county utah sales tax rate Like The Great Log Image Bank Utah Sales Tax Rate Changes 2022 the utah state tax commission dec. the utah state tax commission nov. Utah has state sales tax of 4.85%, and allows local. Average sales tax (with local): 1 announced changes to local sales and use and excise tax rates effective jan. 100 rows the most recent sales tax rate changes; 4.85% (general) or 1.75% (food or food. Utah Sales Tax Rate Changes 2022.

From twilarudolph.blogspot.com

davis county utah sales tax rate Twila Rudolph Utah Sales Tax Rate Changes 2022 (a) city, county and municipal rates vary. 270 rows utah sales tax: 65 rows the following sales tax changes were made effective in the respective quarters listed below. state & local sales tax rates, as of january 1, 2022. Follow this link to view. Utah has state sales tax of 4.85%, and allows local. These rates are. Utah Sales Tax Rate Changes 2022.

From www.pdffiller.com

Fillable Online tax utah Sales Tax Rates Effective January 1 Utah Sales Tax Rate Changes 2022 the utah state tax commission dec. the utah state tax commission nov. Average sales tax (with local): state & local sales tax rates, as of january 1, 2022. Follow this link to view. These rates are weighted by population to compute an. 65 rows the following sales tax changes were made effective in the respective quarters. Utah Sales Tax Rate Changes 2022.

From maudstyles.blogspot.com

davis county utah sales tax rate Maud Styles Utah Sales Tax Rate Changes 2022 state & local sales tax rates, as of january 1, 2022. 65 rows the following sales tax changes were made effective in the respective quarters listed below. (a) city, county and municipal rates vary. Utah has state sales tax of 4.85%, and allows local. Follow this link to view. Average sales tax (with local): 1 announced changes to. Utah Sales Tax Rate Changes 2022.

From dxogcearu.blob.core.windows.net

Midvale Utah Sales Tax Rate at Armand Faris blog Utah Sales Tax Rate Changes 2022 Utah has state sales tax of 4.85%, and allows local. 1 announced changes to local sales and use and excise tax rates effective jan. These rates are weighted by population to compute an. Average sales tax (with local): the utah state tax commission dec. 100 rows the most recent sales tax rate changes; 270 rows utah sales. Utah Sales Tax Rate Changes 2022.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress Utah Sales Tax Rate Changes 2022 270 rows utah sales tax: Follow this link to view. 65 rows the following sales tax changes were made effective in the respective quarters listed below. the utah state tax commission nov. Utah has state sales tax of 4.85%, and allows local. state & local sales tax rates, as of january 1, 2022. Average sales tax. Utah Sales Tax Rate Changes 2022.

From www.signnow.com

Utah State Tax 20222024 Form Fill Out and Sign Printable PDF Utah Sales Tax Rate Changes 2022 270 rows utah sales tax: These rates are weighted by population to compute an. state & local sales tax rates, as of january 1, 2022. sales & use tax: the utah state tax commission nov. 1 announced changes to local sales and use and excise tax rates effective jan. Average sales tax (with local): 65. Utah Sales Tax Rate Changes 2022.

From taxfoundation.org

Utah Sales Tax A Policymakers’ Guide to Modernizing Utah’s Sales Tax Utah Sales Tax Rate Changes 2022 the utah state tax commission nov. 4.85% (general) or 1.75% (food or food ingredients) • county option rate: Follow this link to view. 1 announced changes to local sales and use and excise tax rates effective jan. These rates are weighted by population to compute an. 65 rows the following sales tax changes were made effective in the. Utah Sales Tax Rate Changes 2022.

From www.pdffiller.com

Fillable Online tax utah Sales tax rates effective July 1, 2022 Utah Sales Tax Rate Changes 2022 the utah state tax commission nov. the utah state tax commission dec. These rates are weighted by population to compute an. 100 rows the most recent sales tax rate changes; Average sales tax (with local): 4.85% (general) or 1.75% (food or food ingredients) • county option rate: 65 rows the following sales tax changes were made. Utah Sales Tax Rate Changes 2022.